In this market, what I hear mostly from my retail agent clients is that the major decision factors for physicians buying malpractice insurance are price first, coverage second and claims handling a distant third or not even a consideration at all. We know this is not always the best option and in many cases, the lack of consideration for exceptional claims handling can cost the physician more money in the end.

What entices doctors to select the carrier with the best price? These market conditions: the current soft market; an abundance of medical malpractice carrier competition; and the healthcare market pressures physicians are dealing with.

Payments and outcomes for medical malpractice claims vary greatly between insurance carriers. If a carrier is inexperienced or not in the best shape financially (like many RRGs) they are less likely to defend a claim vigorously and are more likely to settle a defensible claim. Why should a physician care about that? Having more claims has a direct adverse effect on the cost of their coverage. The claims experience of an individual or group of physicians will significantly increase their malpractice insurance premiums for many years – they will pay higher premiums for an extended period of time. That’s why physicians should care about the carrier’s ability to minimize claims. It’s important that they choose a carrier that has the experience and financial resources to get the best result from each and every claim.

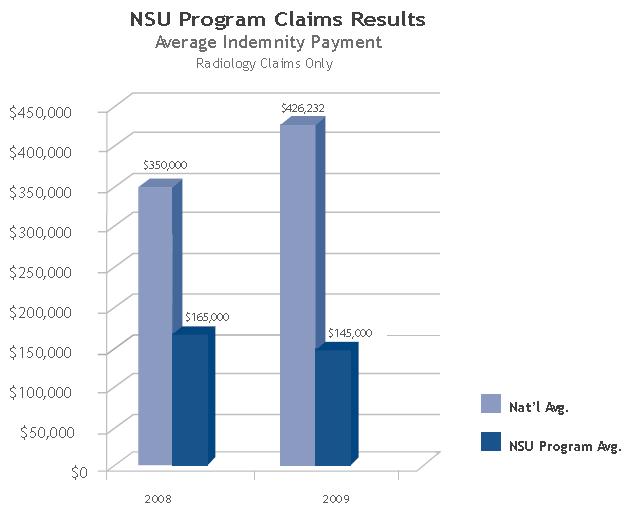

As a stark example, below is a chart comparing a couple of recent years of average of claim payments for radiologists that compares medical malpractice carriers as a whole nationally to the NSU Healthcare medical malpractice program carrier. They leverage their experience and resources to reduce claims and it clearly makes a dramatic difference.

COMMENTS

No comments yet. You should be kind and add one!

The comments are closed.